Exhibit 10.26

DATED 2 November 2009

| APOLLO LEISURE GROUP LIMITED | (1) | |

| THE AMBASSADOR THEATRE GROUP LIMITED | (2) | |

| and |

||

| LIVE NATION, INC | (3) | |

| SHARE PURCHASE AGREEMENT relating to the sale and purchase of the whole of the issued share capital of LIVE NATION (VENUES) UK LIMITED |

Hammonds LLP

7 Devonshire Square London EC2M 4YH DX 136546 Bishopsgate 2

Telephone +44 (0)20 7655 1000

Website www.hammonds.com

Hammonds LLP is a limited liability partnership registered in England and Wales with registered number OC335584. It is regulated by the Solicitors Regulation Authority of England and Wales. A list of the members and their professional qualifications is open to inspection at the registered office 7 Devonshire Square London EC2M 4YH. We use the word “Partner” to refer to a member of Hammonds LLP or an employee or consultant with equivalent standing and qualifications.

Reference: NPA/JHP/CLE.110-231

8636329.03

CONTENTS

| 1 | DEFINITIONS AND INTERPRETATION | 1 | ||

| 2 | SALE AND PURCHASE | 9 | ||

| 3 | CONSIDERATION | 10 | ||

| 4 | EXCHANGE OF CONTRACTS | 10 | ||

| 5 | PRE-COMPLETION OBLIGATIONS | 10 | ||

| 6 | COMPLETION | 11 | ||

| 7 | POST-COMPLETION OBLIGATIONS | 13 | ||

| 8 | WARRANTIES | 13 | ||

| 9 | ADVANCE TICKETS AND FREE CASH RECONCILIATION | 14 | ||

| 10 | NET ASSET STATEMENT | 16 | ||

| 11 | INDEMNITIES | 17 | ||

| 12 | GUARANTEE | 20 | ||

| 13 | SENIOR EMPLOYEES | 21 | ||

| 14 | PENSIONS | 21 | ||

| 15 | CONFIDENTIALITY AND USE OF NAMES | 21 | ||

| 16 | TAX | 22 | ||

| 17 | ANNOUNCEMENTS | 22 | ||

| 18 | GENERAL | 22 | ||

| 19 | ASSIGNMENT | 23 | ||

| 20 | ENTIRE AGREEMENT | 24 | ||

| 21 | NOTICES | 24 | ||

| 22 | COUNTERPARTS | 25 | ||

| 23 | GOVERNING LAW AND JURISDICTION | 25 | ||

i

| SCHEDULE 1 | 27 | |

| PART 1 – TARGET GROUP | 27 | |

| PART 2 – DETAILS OF THE TARGET | 28 | |

| PART 3 – SUBSIDIARY | 29 | |

| SCHEDULE 2 WARRANTIES | 30 | |

| SCHEDULE 3 LIMITATIONS | 47 | |

| SCHEDULE 4 PROPERTIES | 51 | |

| SCHEDULE 5 BUYER’S WARRANTIES | 53 | |

| SCHEDULE 6 TAX | 54 | |

| SCHEDULE 7 THE NET ASSET STATEMENT | 81 | |

| SCHEDULE 8 ADVANCE TICKET AND FREE CASH RECONCILIATION

AGREED FORM DOCUMENTS |

83 | |

| Disclosure Letter | ||

| ENA Methodology | ||

| Officer Resignation Letters | ||

| Pension Scheme Trustee Resignations | ||

| Security Interest Releases | ||

| Ticketmaster Deed of Accession | ||

| Trade Mark Licence | ||

| Transitional Services Agreement | ||

ii

| DATE OF AGREEMENT | 2 November 2009 |

PARTIES

| (1) | APOLLO LEISURE GROUP LIMITED, a company incorporated in England (company number: 2129195) whose registered office is at 2nd Floor Regent Arcade House 19-25 Argyll Street London W1F 7TS (the “Seller”); |

| (2) | THE AMBASSADOR THEATRE GROUP LIMITED, a company incorporated in England (company number 02671052) of The Ambassadors, Peacocks Centre, Woking, Surrey, GU21 6GQ (the “Buyer”); and |

| (3) | LIVE NATION, INC., a company incorporated in Delaware of 9348 Civic Center Drive, Beverly Hills, California 90210, United States (the “Guarantor”). |

INTRODUCTION

| A | The Seller is the legal and beneficial owner of the whole of the issued share capital of the Target. |

| B | The Seller has agreed to sell the whole of the issued share capital of the Target to the Buyer on the terms of this agreement. |

| C | The Guarantor has agreed to guarantee the obligations of the Seller under this agreement. |

IT IS AGREED THAT:

| 1 | DEFINITIONS AND INTERPRETATION |

| 1.1 | In this agreement the following words and expressions shall have the following meanings. |

“Advance Payments” means all amounts paid by the Target on or before the Transfer Date in respect of goods or services to be supplied to the Target pursuant to any Contract after the Transfer Date.

“Advance Ticket Receipts” means all amounts paid to the Target on or before the Transfer Date in respect of the sale of tickets for events to be held in the Theatres after the Transfer Date calculated on the same basis and taking into account the items, as set out in, the proforma illustration of Advance Ticket Receipts as set out at Schedule 8.

“ASB” means the Accounting Standards Board Limited, a company registered in England and Wales (company number 2526824), or such other body prescribed by the Secretary of State from time to time pursuant to the Companies Acts.

“Associate” means any person, firm or company which is a connected person (as defined in section 839 Taxes Act) of the Seller, or which is an associated company of the Seller within the meaning of section 416 Taxes Act but excluding the Target Group.

“Book Debts” means all trade and other debts, such debts to include VAT (whether due for payment or not), owing to the Target as at the Transfer Date but excluding any debts owing from any member of the Seller’s Group.

1

“Business” means the business of operating and where applicable owning each of the Properties as carried on by the Target Group at the Signing Date.

“Business Day” means any day (other than a Saturday, Sunday or a bank or public holiday) during which clearing banks are open for business in the City of London.

“Buyer’s Group” means the Buyer, any subsidiary of the Buyer, any holding company of the Buyer and any subsidiary of any holding company of the Buyer, from time to time.

“Buyer’s Solicitors” means Denton Wilde Sapte LLP of One Fleet Place, London, EC4M 7WS.

“Buyer’s Solicitors Bank Account” means the bank account with account number 67072440 and sort code 15-80-00.

“Cash at Bank” means the actual positive £(sterling) cash figure as represents cash held in the Target’s bank accounts as at the Transfer Date as stated in the books and records of the Target excluding the London Show Escrow Accounts.

“Companies Acts” means the applicable provisions of the Companies Act 1985 and the Companies Act 2006 from time to time in force and as they are supplemented and amended.

“Completion” means completion of the sale and purchase of the Shares on the Completion Date in accordance with clause 6.

“Completion Date” means no later than 16:59 GMT hours on 2 November 2009.

“Confidential Business Information” means all or any information of a secret or proprietary or confidential nature (however stored) and not publicly known which is owned by any member of the Target Group and which is used primarily in relation to the business of the Target Group including the Database.

“Contract” means any contract or commitment (whether written or oral) to which any member of the Target Group is a party which is wholly or partly unperformed as at the Signing Date but excluding rights in respect of any leases, tenancies or licences under which certain of the Properties are held.

“Database” means the database of individuals who have purchased tickets for productions presented or to be presented at the Theatres and/or applied for membership of the Live Card programme (including the address, telephone and/or email address of such individuals).

“Data-Protection Legislation” means:

| (a) | the Data Protection Act 1998 (as the same may be amended or modified from time to time); |

| (b) | the Privacy and Electronic Communications (EC Directive) Regulations 2003 as may be amended or modified from time to time; |

2

| (c) | all or any guidance or codes of practice issued by the Information Commissioner’s Office, and any statutes, regulations or directives from time to time relating to the processing of personal data; and |

| (d) | any regulations, laws, codes, guidance and restrictions in each jurisdiction in which the relevant member of the Target Group has a permanent establishment, agency or place of business or in which it carries on any trade or in which it receives, stores, maintains, processes, controls or transmits or relays personal data (including sensitive personal data). |

“Data Room” means the electronic data room containing documents and information relating to the Target Group made available by the Seller, the contents of which are listed in the Data Room Index.

“Data Room Index” means the index of documents attached at Appendix 1 to the Disclosure Letter.

“Disclosure Bundle” means the documents in the agreed form attached to or referred to in the Disclosure Letter.

“Disclosure Letter” means the letter in the agreed form dated the same date as this agreement from the Seller to the Buyer disclosing information, including the contents of the Data Room, constituting exceptions to the Warranties and the Tax Warranties and details of other matters referred to in this agreement.

“Dominion Theatre” means the Dominion Theatre, 268-269 Tottenham Court Road, London, W1T 7AQ more particularly described in a sub lease dated 20 May 1988 made between Butlins Limited (1) and Saveflex Limited (2) registered at the Land Registry with Title Absolute under title number NGL616483.

“ENA Methodology” means the methodology in the agreed form as is to be adopted by the parties in determining the Estimated Net Assets.

“Estimated Advance Ticket Receipts” means the £(sterling) figure agreed as an estimate of the Advance Ticket Receipts being £22,739,092.

“Estimated Cash at Bank” means the £(sterling) figure agreed as an estimate of the Cash at Bank being £734,763.

“Estimated Free Cash” means the £(sterling) figure agreed as an estimate of the Free Cash being £841,799.

“Estimated Net Assets” means the £(sterling) figure agreed in accordance with the ENA Methodology as an estimate of the Net Assets being minus £4,267,459 (-£4,267,459).

“Estimated Reconciliation” means the £(sterling) figure as representing the Estimated Advance Ticket Receipts less the Estimated Free Cash being £21,897,292.

“Estimated Theatre Float” means the £(sterling) figure agreed as an estimate of the Theatre Float being £107,036.

“Free Cash” means the Theatre Float and the Cash at Bank.

3

“GAAP” means generally accepted accounting practices, principles and standards in compliance with all applicable laws in the United Kingdom including without limitation the legal principles set out in the Companies Acts, rulings and abstracts of the ASB and guidelines, conventions, rules and procedures of accounting practice in the United Kingdom which are regarded as permissible by the ASB.

“Indebtedness” means all Intercompany Indebtedness and any indebtedness as represents borrowings from a financial institution made to any member of the Target Group (whether or not due for payment) by any lending institution.

“Intellectual Property” means any patents, trade marks, goodwill or right to sue for passing off, copyrights and related rights, registered designs, unregistered design rights, database rights, performers’ rights, trade secrets and other confidential information, know-how, business or trade names (including internet domain names and e-mail address names) and all other intellectual and industrial property and rights of a similar or corresponding nature in any part of the world for the full term of the rights, whether registered or not or capable of registration or not, and including the right to apply for and all applications for any of the foregoing rights and:

| (a) | any similar or equivalent rights and assets; |

| (b) | any licences, applications, permissions or consents granted, applied for or given in respect of the rights in any of the above; and |

| (c) | designations and rights under any international convention for protection of any of the rights in any of the above, |

which may now or in the future subsist anywhere in the world.

“Interest” means an annual rate equal to one per cent. (1%) above the base rate of Barclays Bank plc from time to time, calculated on a daily basis.

“IP Agreements” means all arrangements, agreements, licences, authorisations and permissions (in whatever form and whether express or implied) under which any member of the Target Group:

| (a) | uses or exploits Third Party Intellectual Property Rights; and |

| (b) | has licensed or agreed to license Intellectual Property to, or otherwise permitted the use of any Target Intellectual Property Rights by, any third party. |

“Intercompany Indebtedness” means any indebtedness (whether or not due for payment) of any member of the Target to:

| (a) | any member of the Seller’s Group; or |

| (b) | any director, officer, employee or shareholder of any member of the Seller’s Group, |

but shall not include any items on normal trading account or any salary payments or proper expenses of directors and employees of any member of the Target Group fairly listed in the Disclosure Letter.

4

“Last Accounts” means the audited balance sheet of the Target as at the Last Accounts Date and the audited profit and loss account of the Target made up to the Last Accounts Date and the auditor’s and the directors’ reports and notes thereon.

“Last Accounts Date” means 31 December 2008.

“Leakage” means:

| (a) | any dividend or distribution declared, paid or made by the Target to or for the benefit of the Seller; or |

| (b) | any payments made (or future benefits granted) to (or assets transferred to, or liabilities assumed, indemnified, guaranteed, secured or insured for the benefit of) any member of the Seller’s Group; or |

| (c) | any payments made by the Target to, or at the direction of, the Seller’s Group in respect of any share capital or other securities of the Target being created, issued, redeemed, purchased or repaid or any other return of capital; or |

| (d) | the waiver, release or discount by the Target of any amount owed to it by the Seller’s Group; or |

| (e) | any payment or obligation to pay or incur any third party costs or expenses relating to the transactions contemplated by this Agreement; or |

| (f) | any agreement or arrangement made or entered into by the Target to do or give effect to any matter referred to in (a) to (e) above. |

“Leases” means the leases in place in respect of such of the Properties as are held on a leasehold basis as set out at Schedule 4.

“Live Nation GPPP” means the Live Nation Group Personal Pension Plan with Friends Provident.

“Live Nation Life Assurance Scheme” means the life assurance only scheme known as the Live Nation (Venues) UK Limited Group Life Assurance Scheme.

“Live Nation Limited” means Live Nation Limited (company number: 3805556) of 2nd Floor, Regent Arcade House, 19-25 Argyll Street, London W1F 7TS.

“Live Nation Pension Scheme” means the defined benefit, occupational pension scheme known as the Live Nation (Venues) UK Limited Pension & Life Assurance Scheme (Pensions Regulator registration number 10216092).

“Live Nation Pension Scheme Valuation” means the actuarial valuation of the Live Nation Pension Scheme as at 1 April 2009 for the purposes of section 224 of the Pensions Act 2004.

“Live Nation Stakeholder Scheme” means the Live Nation Group Stakeholder Pension Plan with Friends Provident.

5

“London Show Escrow Accounts” means such balances as are held in escrow in respect of each of the Lion King and the Wicked productions currently showing at each of the Lyceum and Apollo Victoria.

“Mackintosh Foundation Charge” has the meaning given to it in Part 2 of Schedule 1.

“Management Accounts” means the unaudited balance sheet and profit and loss account of the Target and the Target cash flow for each month in the 9 month period ended on 30 September 2009.

“Material Contracts” means those contracts of the Target Group listed as such in a Appendix 2 to the Disclosure Letter.

“Net Assets” means the net current assets of the Target at the Transfer Date as calculated in accordance with the provisions of Schedule 7.

“Net Asset Statement” means the statement to be prepared in accordance with the provisions of clause 10 and Schedule 7 showing the Net Assets in the format set out in Part 3 of Schedule 7.

“Ordinary Presenting Agreement” means any agreement under which any person is granted the right to hire and/or use all or any part of the Properties for any particular event or events whether for a single date or for multiple dates.

“Owned Target Intellectual Property Rights” means all the Intellectual Property owned by any member of the Target Group including the Database.

“Pension Payment” means the pension payment of £1,392,000 to be made immediately before Completion such payment representing a settlement as calculated by reference to the funding deficit in the Live Nation Pension Scheme as measured on an ongoing basis as at 1 April 2009 with such payment having been made by the Target to the trustees of the Live Nation Pension Scheme using funds provided to the Target by the Seller’s Group recognising that less than 10% of the members of the Live Nation Pension Scheme are current employees of the Target and that the majority of members of the Live Nation Pension Scheme are not (or as the case may be were not) employed at any of the Properties and instead provide or provided (as the case may be) their services in respect of other venues either owned or managed or formerly owned or managed by either the Target or the Seller’s Group.

“Pension Schemes” means the Live Nation Pension Scheme, the Live Nation GPPP, the Live Nation Stakeholder Scheme and the Live Nation Life Assurance Scheme.

“Properties” means all the freehold and leasehold properties owned or occupied or used by any member of the Target Group, brief details of which are set out in Part 1 of Schedule 4 and “Property” means any one of them.

“Property Creditors” means any and all liabilities of any member of the Target Group in respect of the Properties arising in connection with (i) dilapidations and/or (ii) any obligation to repair, or redecorate, or reinstate or on account of any other works to be carried out at any of the Properties not subject to the Leases.

“Reconciliation” means the actual £(sterling) figure as represents the Advance Ticket Receipts less the Free Cash as such figure is calculated in accordance with the provisions of clause 9 by reference to the format for such calculation as set out in Schedule 8.

6

“Relevant Benefits” has the meaning set out in section 393(B)(1) of the Income Tax (Earnings and Pensions) Act 2003 but as if section 393(B)(2) did not apply and shall include benefits within section 393(B)(3).

“Security Interest” means any mortgage, charge, assignment, guarantee, indemnity, debenture, pledge, declaration of trust, lien, right of set off or any encumbrance.

“Seller’s Group” means the Seller, any subsidiary undertaking of the Seller, any parent undertaking of the Seller and any subsidiary undertaking of any parent undertaking of the Seller and any associated undertaking of any such person, from time to time, but excluding the Target Group.

“Seller’s Solicitors” means Hammonds LLP of 7 Devonshire Square London EC2H 4YH (ref: NPA/CLE.110-231).

“Seller’s Solicitors Bank Account” means Hammonds LLP client account number 00199536, sort code 30-00-05 at Lloyds TSB, 6-7 Park Row, Leeds LS1 1NX.

“Shares” means the 200 ordinary shares of £1.00 each in the capital of the Target.

“Signing Date” means the date of this agreement.

“Subsidiary” means First Family Entertainment LLP, brief details of which are set out in Part 3 of Schedule 1.

“Target” means Live Nation (Venues) UK Limited, brief details of which are set out in Part 2 of Schedule 1.

“Target Group” means the Target and the Subsidiary.

“Target Intellectual Property Rights” means all the Intellectual Property owned, used or held for use by any member of the Target Group including the Database.

“Tax” has the meaning given to it in Schedule 6.

“Tax Authority” has the meaning given to it in Schedule 6.

“Tax Covenant” has the meaning given to it in Schedule 6.

“Tax Warranties” has the meaning given to it in Schedule 6.

“Taxes Act” has the meaning given to it in Schedule 6.

“Theatre Float” means the actual aggregate amount of cash held by the Target at each Theatre as at the Transfer Date.

“Theatres” means each of the Properties save for Grehan House, Oxford and School House, Manchester.

7

“Third Party Intellectual Property Rights” means all Intellectual Property owned by a third party and used or held for use by any member of the Target Group.

“Ticketmaster” means Ticketmaster of 3701 Wilshire Boulevard, 9th Floor, Los Angeles, California, 90010 and Ticketmaster UK Limited of 48 Leicester Square, London EC2H 7LR.

“Ticketmaster Agreement” means the agreement between SFX Entertainment Inc (now Live Nation, Inc) and SFX UK Holdings Limited (now Live Nation Limited) dated 28 March 2001.

“Ticketmaster Accession Agreement” means the accession agreement in the agreed form to be entered into between the Buyer, the Seller, Live Nation Limited, the Guarantor and Ticketmaster on Completion.

“Trade Mark Licence” means the licence granted by Live Nation (Music) UK Limited, a member of the Seller’s Group to the Target to use the “Apollo” name in the agreed form.

“Transfer Agreements” means the business sale and purchase agreements entered into by the Target with each of Apollo Leisure Group Limited and Live Nation (Music) UK Limited respectively copies of which are included in the Disclosure Bundle.

“Transfer Date” means 11:59pm on Saturday, 31 October 2009;

“Transitional Services Agreement” means the agreement in the agreed form to be entered into between the Buyer and the Seller on Completion.

“UKLA” means the Financial Services Authority acting in its capacity as the UK Listing Authority.

“Warranties” means the warranties set out in Schedule 2.

| 1.2 | Any reference to a statutory provision shall be construed as including references to all statutory provisions or other subordinate legislation made pursuant to that statutory provision. |

| 1.3 | Unless the context otherwise requires, all words and expressions which are defined in the Companies Acts shall have the same meanings in this agreement. |

| 1.4 | A person is “connected” with another if that person is connected with another within the meaning of Section 839 of the Income and Corporation Taxes Act 1988. |

| 1.5 | Unless the context otherwise requires: |

| (a) | words denoting the singular include the plural and vice versa; |

| (b) | words denoting any gender include all other genders; |

| (c) | any reference to “persons” includes individuals, bodies corporate, companies, partnerships, unincorporated associations, firms, trusts and all other legal entities; |

| (d) | all references to time are to London time; |

8

| (e) | any reference to a party is to a party to this agreement. |

| 1.6 | Clause headings are for convenience only and shall not affect the interpretation of this agreement. Any reference to a clause, sub-clause, paragraph or schedule is to the relevant clause, sub-clause, paragraph or schedule of this agreement. |

| 1.7 | The schedules to this agreement shall for all purposes form part of this agreement. |

| 1.8 | Any reference to a document being in the “agreed form” means a document in a form agreed by the parties and initialled by, or on behalf of, each of them for the purposes of identification. |

| 1.9 | Any phrase introduced by the terms “including”, “include”, “in particular” or any similar expression shall be construed as illustrative and shall not limit the sense of the words preceding those terms. |

| 2 | SALE AND PURCHASE |

| 2.1 | Subject to the terms and conditions of this agreement, the Seller shall at Completion sell with full title guarantee and the Buyer shall purchase the Shares and section 6(2) of the Law of Property Miscellaneous Provisions Act 1994 shall not apply to such sale and purchase. |

| 2.2 | The Seller shall at Completion waive: |

| (a) | all pre-emption rights in respect of the Shares; and |

| (b) | any other rights which restrict the transfer of the Shares, |

conferred on the Seller whether by the articles of association of the Target, by agreement or otherwise.

| 2.3 | The Seller covenants with the Buyer that: |

| (a) | the Shares are fully paid (or credited as fully paid) and constitute the whole of the allotted and issued share capital of the Target; |

| (b) | the Seller is entitled to sell and transfer the full legal and beneficial ownership of the Shares to the Buyer on the terms set out in this agreement without the consent of any third party; and |

| (c) | the Shares will be sold and transferred to the Buyer free from all Security Interests and together with all accrued benefits and rights attaching or accruing to the Shares, including all dividends declared on or after the date of this agreement. |

| 2.4 | Each of the covenants given by the Seller pursuant to clause 2.3 will be deemed to be repeated at Completion. |

| 2.5 | Notwithstanding anything to the contrary in this agreement, the Target’s interest in the Dominion Theatre is excluded from this agreement and the transactions contemplated hereby. The Buyer acknowledges and agrees that: |

| (a) | the Consideration excludes the Target’s interest in the Dominion Theatre; |

9

| (b) | neither it nor any member of the Target Group shall have any interest whatsoever in or to the Dominion Theatre after Completion; and |

| (c) | the Buyer will (at the Seller’s sole cost and expense) take such all further actions after Completion upon the Seller’s request as may be reasonably necessary to fully complete the assignment and transfer of the Target’s interest in the Dominion Theatre from the Target Group to the Seller’s Group. |

| 3 | CONSIDERATION |

The consideration for the purchase of the Shares shall be the sum of £90,000,000 payable in cash at Completion subject to adjustment in accordance with this agreement (the “Consideration”).

| 4 | EXCHANGE OF CONTRACTS |

| 4.1 | Exchange of contracts (“Exchange”) shall take place at the offices of the Sellers’ Solicitors immediately after the signing of this agreement on the date of this agreement when each of the events in clauses 4.2 to 4.3 shall occur. |

| 4.2 | At Exchange, the Seller shall deliver to the Buyer: |

| (a) | the Disclosure Letter duly executed for and on behalf of the Seller; |

| (b) | the Trade Mark Licence in the agreed form; |

| (c) | the Ticketmaster Accession Agreement in the agreed form; and |

| (d) | the Transitional Services Agreement in the agreed form. |

| 4.3 | At Exchange, there shall be delivered or made available to the Buyer by the Seller as evidence of the authority of each person entering into an agreement or document on behalf of the Seller, a certified copy of a resolution of the board of directors (or a duly authorised committee) of the Seller and/or a power of attorney conferring such authority. |

| 4.4 | Upon completion of all of the matters specified in clauses 4.2 to 4.3: |

| (a) | the Buyer shall deliver the Disclosure Letter duly executed for and on behalf of the Buyer; and |

| (b) | as evidence of the authority of each person entering into an agreement or document on behalf of the Buyer, the Buyer shall deliver to the Seller a certified copy of a resolution of the board of directors (or a duly authorised committee) of the Buyer and/or a power of attorney conferring such authority. |

| 5 | PRE-COMPLETION OBLIGATIONS |

| 5.1 | In the period from the Signing Date until Completion the Seller shall procure that the Target Group shall: |

| (a) | carry on the Business as a going concern in the normal and ordinary course of business as the Target Group has run the Business for the last twelve months so far as reasonably practicable; |

10

| (b) | not grant or create or agree to grant any Security Interest over or affecting the Target Group; |

| (c) | keep the Buyer updated upon reasonable written request in respect of the Business and promptly provide to the Buyer any information which it may reasonably require in relation to the Business; and |

| (d) | ensure that all financial transactions relating to the Business shall be conducted through the Target’s bank account or in the cash float at each of the Theatres. |

| 5.2 | The Seller shall maintain in force (or procure that any relevant member of the Seller’s Group shall maintain in force) up to and including the Completion Date all policies of insurance relating to the Target Group and which are in force at the Signing Date. If any of the Properties or any of the material physical assets in the properties are lost, destroyed or damaged prior to the Completion Date, the Seller shall procure that any insurance monies recoverable in respect thereof shall be paid to the Target and the Seller shall (or shall procure that any other relevant person shall) direct the relevant insurance company accordingly, and in such event any such insurance monies received by the Seller shall be promptly paid to the Buyer and pending such payment shall be held by it on trust for the Buyer absolutely. |

| 5.3 | The Seller shall covenant to the Buyer that between Exchange and Completion: |

| (a) | no member of the Seller’s Group will receive or benefit from or will become entitled to receive any Leakage; and |

| (b) | no member of the Seller’s Group will consent to or vote in favour of any Leakage being paid or made, |

provided that this clause 5 shall not prevent the operation of the Transfer Agreements and it is agreed that any sums received by the Target in relation to the business transferred under the Transfer Agreements shall be promptly paid to the Seller by the Target.

| 5.4 | The Seller shall pay to the Buyer on demand an amount equal to any Leakage. |

| 6 | COMPLETION |

| 6.1 | Completion shall take place at the offices of the Seller’s Solicitors on the Completion Date or at such agreed time prior to the Completion Date when each of the events set out in clauses 6.2 to 6.4 shall occur. |

| 6.2 | At Completion, the Seller shall deliver to the Buyer: |

| (a) | duly completed and executed transfers of the Shares in favour of the Buyer or as it directs; |

| (b) | the certificates for the Shares; |

11

| (c) | the resignations of Paul Robert Latham, Stuart Robert Douglas and Alan Brian Ridgeway as directors or as members (as applicable) of each member of the Target Group and the secretary of each member of the Target Group in the agreed form from their respective offices; |

| (d) | the resignations of each of David Vickers and Brian Newman as trustees of the Pension Schemes in the agreed form; and |

| (e) | evidence in the agreed form that all charges, debentures and other Security Interests (other than the Mackintosh Foundation Charge) affecting each member of the Target Group have been released and discharged in full. |

| 6.3 | At Completion, there shall be delivered or made available to the Buyer by the Seller: |

| (a) | the Trade Mark Licence duly executed for and on behalf of Live Nation (Music) UK Limited and the Target; |

| (b) | the Ticketmaster Accession Agreement duly executed for and on behalf of the Seller and each applicable member of the Seller’s Group and Ticketmaster; and |

| (c) | the Transitional Services Agreement duly executed for and on behalf of the Seller and the Guarantor; |

| (d) | the register of members and other statutory registers of the Target duly made up to Completion; |

| (e) | an amount equal to the Estimated Reconciliation less the amounts standing in the London Show Escrow Accounts (as specified in Schedule 8) such aggregate amount to be paid by the Seller to the Buyer’s Solicitor’s Bank Account at Completion; |

| (f) | the title deeds relating to each of the Properties as are in the possession of the Target as set out at section 1.12 of the Data Room; |

| (g) | the Pension Payment shall be made by way of a bankers draft from the Seller’s Group on behalf of the Target; and |

| (h) | bank statements of all bank accounts of the Target as at a date not more than 5 Business Days prior to Completion. |

| 6.4 | The Seller shall procure that at Completion, a board meeting of the Target shall be duly convened and held at which, with effect from Completion: |

| (a) | the transfers referred to in clause 6.2(a) shall (subject to applicable stamping) be approved and registered; |

| (b) | such persons as the Buyer shall nominate shall be appointed as directors and as the secretary of the Target and the resignations referred to in clause 6.2(c) shall be submitted and accepted; |

| (c) | any Intercompany Indebtedness shall be settled in full; and |

12

| (d) | the registered office of the Target shall be changed to such address as the Buyer shall specify. |

| 6.5 | Upon completion of all of the matters specified in clauses 6.2 to 6.4 the Buyer shall: |

| (a) | pay the sum of £90,000,000 by telegraphic transfer to the Seller’s Solicitors Bank Account; and |

| (b) | the Buyer shall deliver to the Seller the Ticketmaster Accession Agreement duly executed on behalf of the Buyer and on behalf of Ticketmaster; and |

| (c) | the Buyer shall deliver to the Seller the Transitional Services Agreement duly executed on behalf of the Buyer. |

| 6.6 | The Buyer may in its absolute discretion waive any requirement contained in clauses 6.2 to 6.4 (inclusive) but shall not be obliged to complete the purchase of any of the Shares unless the purchase of all the Shares is completed simultaneously in accordance with such clauses and this agreement. |

| 7 | POST-COMPLETION OBLIGATIONS |

| 7.1 | The Seller undertakes that, immediately following Completion until such time as the transfers of the Shares have been registered in the register of members of the Target, the Seller will hold those Shares registered in its name on trust for and as nominee for the Buyer or its nominee(s) and undertakes to hold all dividends and distributions and exercise all voting rights available in respect of the Shares in accordance with the directions of the Buyer or its nominee(s) and if the Seller is in breach of the undertakings contained in this clause the Seller irrevocably authorises the Buyer to appoint some person or persons to execute all instruments or proxies (including consents to short notice) or other documents which the Buyer or its nominee(s) may reasonably require and which may be necessary to enable the Buyer or its nominee(s) to attend and vote at general meetings of the Target and to do any thing or things necessary to give effect to the rights contained in this clause 7.1. |

| 7.2 | With effect from Completion, the parties agree that the confidentiality undertaking dated 20 May 2009 between the Seller and the Buyer relating to the Target Group shall be terminated. |

| 8 | WARRANTIES |

| 8.1 | As at the Signing Date the Seller warrants to the Buyer that each Warranty and Tax Warranty is true and accurate and not misleading as at the date of this agreement, subject only to: |

| (a) | any matter fairly disclosed in the Disclosure Letter; |

| (b) | the limitations and qualifications set out in this clause 8 and Schedule 3; and |

| (c) | in relation to the Tax Warranties only, the limitations and qualifications set out in Part 4 of Schedule 6. |

| 8.2 | Each Warranty and Tax Warranty made or given in respect of the Target shall be deemed to be a warranty made or given in respect of each member of the Target Group and (unless the context or subject matter otherwise requires) the expression the “Target” in the Warranties and the Tax Warranties shall be construed accordingly. |

13

| 8.3 | If any Warranty or Tax Warranty is qualified by the expression “so far as the Seller is aware” or “to the best of the knowledge, information and belief of the Seller” or words to such effect, such expression shall mean that the Seller shall be deemed to have knowledge of all facts, matters and circumstances actually known to the Seller and which would have been known to the Seller had it made all reasonable enquiries of the Seller’s Group regarding the subject matter of the Warranty or Tax Warranty. |

| 8.4 | Notwithstanding any other provisions of this agreement or any other agreement or document entered into pursuant to this agreement, none of the limitations contained in this clause 8, Schedule 3, Schedule 6 or the Disclosure Letter nor any statutory limitation shall apply to any claim for breach of the Warranties, the Tax Warranties or under the Tax Covenant where the fact, matter or circumstance giving rise to the claim arises as a result of fraud by the Seller. |

| 8.5 | If any amount is paid by the Seller in respect of a breach of any Warranty or Tax Warranty or otherwise pursuant to this clause 8, the amount of such payment shall be deemed to constitute a reduction in the consideration payable under this agreement. |

| 8.6 | The liability of the Seller under the Warranties, the Tax Warranties and the Tax Covenant should be limited pursuant to the provisions of Schedule 3 and Part 4 of Schedule 6. |

| 8.7 | The Seller agrees that any information supplied by the Target or the Subsidiary or by or on behalf of the employees, directors, agents or officers of the Target and the Subsidiary (“Officers”) to the Seller or its advisers in connection with the Warranties, the information disclosed in the Disclosure Letter or otherwise shall not constitute a warranty, representation or guarantee as to the accuracy of such information provided by the Target, the Subsidiary or the Officers in favour of the Seller, and the Seller hereby undertakes to the Buyer and to the Target, the Subsidiary and each Officer that it waives any and all claims which it might otherwise have against any of them in respect of such claims. |

| 8.8 | The Buyer warrants to the Seller in the terms set out in Schedule 5. |

| 9 | ADVANCE TICkETS AND FREE CASH RECONCILIATION |

| 9.1 | As soon as reasonably practicable after the Signing Date and in any event within 14 days of the Signing Date, the Seller shall prepare and submit to the Buyer a draft of the Reconciliation (the “Draft Reconciliation”). The Draft Reconciliation shall be prepared in accordance with the format as set out at Schedule 8 and shall give a figure for the Reconciliation. The Buyer shall procure that the Seller is given all such assistance and access to all such information in the Buyer’s possession or control as it may reasonably require in order to enable the Seller to prepare the Draft Reconciliation. |

| 9.2 | The Buyer shall, within 10 Business Days after receipt of the Draft Reconciliation, give written notice to the Seller stating whether or not the Buyer proposes any amendments to the Draft Reconciliation. |

| 9.3 | Unless the Buyer gives notice in accordance with clause 9.2 that it has proposed amendments to the Draft Reconciliation, then the Draft Reconciliation shall constitute the Reconciliation for the purposes of this Agreement. If the Buyer gives notice in |

14

accordance with clause 9.2 that it has proposed amendments to the Draft Reconciliation then the Buyer and the Seller shall, within the period of 5 Business Days after receipt by the Seller of such notice, seek to agree the proposed amendments.

| 9.4 | In the event of: |

| (a) | a failure by the Seller to submit the Draft Reconciliation to the Buyer within the period referred to in clause 9.1; or |

| (b) | any dispute between the Buyer and the Seller as to any matter relevant to the Draft Reconciliation remaining unresolved at the expiry of the period of 5 Business Days referred to in clause 9.3; |

such failure or dispute shall be referred to an independent firm of chartered accountants agreed by the Buyer and the Seller within 5 Business Days of such failure or notification of dispute or, in the event of a failure to agree such firm within 5 Business Days, to an independent firm of chartered accountants appointed by the President for the time being of the Institute of Chartered Accountants in England and Wales on the application of either the Buyer or the Seller (the “Accountants”). Such Accountants shall determine the Reconciliation. The fees of any such Accountants shall be paid by the Buyer and/or the Seller in the proportions determined by the Accountants. The Buyer and the Seller shall procure that such Accountants are given all such assistance and access to all such information in the Buyer’s or (as the case may be) the Seller’s possession or control as the Accountants may reasonably require in order to determine the Reconciliation. Any Accountants appointed under this clause 9 shall act as experts and not as arbitrators and their determination shall be binding on the parties.

| 9.5 | If the Reconciliation provides a figure which is: |

| (a) | a lower figure than the Estimated Reconciliation then the Buyer shall pay to the Seller in cash a sum equal to the amount of any short fall; |

| (b) | a greater figure than the Estimated Reconciliation then the Seller shall pay to the Buyer in cash a sum equal to the amount of any excess; and |

any payment required under the preceding provisions of this clause 9 shall be made in the case of the payment to the Seller by means of a telegraphic transfer to the Seller’s Solicitors Bank Account and in the case of a payment to the Buyer by means of a telegraphic transfer to the Buyer’s Solicitors Bank Account. Any sum which becomes payable under this clause shall be due for payment within 3 Business Days of the Reconciliation being determined. Any sum which becomes payable by the Buyer to the Seller under the preceding provisions of this clause 9.5 shall constitute a corresponding increase in the Consideration whilst any sum which becomes payable by the Seller to the Buyer under the preceding provisions of this clause 9.5 shall constitute a corresponding reduction in the amount of the Consideration.

| 9.6 | Any payment made pursuant to clause 9 shall carry Interest from the Signing Date to the date of actual payment (both dates inclusive). |

| 9.7 | For the avoidance of doubt no payment shall be payable under the terms of this clause 9 if Completion does not take place. |

15

| 10 | NET ASSET STATEMENT |

| 10.1 | As soon as reasonably practicable after Completion and in any event within 60 days of the Signing Date, the Buyer shall prepare and submit to the Seller a draft of the Net Asset Statement (the “Draft Statement”). The Draft Statement shall be prepared in accordance with Schedule 7 and shall give a figure for the Net Assets. The Seller shall procure that the Buyer is given all such assistance and access to all such information in the Seller’s possession or control as it may reasonably require in order to enable the Buyer to prepare the Draft Statement. |

| 10.2 | The Seller shall, within 15 Business Days after receipt of the Draft Statement, give written notice to the Buyer stating whether or not the Seller proposes any amendments to the Draft Statement. |

| 10.3 | Unless the Seller gives notice in accordance with clause 10.2 that it has proposed amendments to the Draft Statement, then the Draft Statement shall constitute the Net Asset Statement for the purposes of this Agreement. If the Seller gives notice in accordance with clause 10.2 that it has proposed amendments to the Draft Statement then the Buyer and the Seller shall, within the period of 10 Business Days after receipt by the Buyer of such notice, seek to agree the proposed amendments. |

| 10.4 | In the event of: |

| (a) | a failure by the Buyer to submit the Draft Statement to the Seller within the period referred to in clause 10.1; or |

| (b) | any dispute between the Buyer and the Seller as to any matter relevant to the Draft Statement or the Net Asset Statement remaining unresolved at the expiry of the period of 10 Business Days referred to in clause 10.3; |

such failure or dispute shall be referred to the Accountants in accordance with the provisions as pertain to the appointment of the Accountants as set out at clause 9.4. Such Accountants shall determine the Net Asset Statement. The fees of any such Accountants shall be paid by the Buyer and/or the Seller in the proportions determined by the Accountants. The Buyer and the Seller shall procure that such Accountants are given all such assistance and access to all such information in the Buyer’s or (as the case may be) the Seller’s possession or control as the Accountants may reasonably require in order to determine the Net Asset Statement. Any Accountants appointed under this clause 10 shall act as experts and not as arbitrators and their determination shall be binding on the parties.

| 10.5 | If the Net Assets (being negative) comprise: |

| (a) | a greater negative sum than the Estimated Net Assets then the Seller shall pay to the Buyer in cash a sum equal to the amount of any such excess; |

| (b) | a lower negative sum than the Estimated Net Assets then the Buyer shall pay to the Seller in cash a sum equal to the amount by which it is lower; |

So that, by way of example, if the Estimated Net Assets are minus £1,000 (-£1,000) and the Net Assets are minus £1,500 (-£1,500) the Net Assets would be a greater negative sum than the Estimated Net Assets. If the Estimated Net Assets are minus £1,000 (-£1,000) and the Net Assets are minus £500 (-£500) then the Net Assets would be a lower negative sum than the Estimated Net Assets.

16

Any payment required under the preceding provisions of this clause 10 shall be made in the case of the payment to the Seller by means of a telegraphic transfer to the Seller’s Solicitors Bank Account and in the case of a payment to the Buyer by means of a telegraphic transfer to the Buyer’s Solicitors Bank Account. Any sum which becomes payable under this clause shall be due for payment within 3 Business Days of the Net Asset Statement being determined. Any sum which becomes payable by the Buyer to the Seller under the preceding provisions of this clause 10.5 shall constitute a corresponding increase in the Consideration whilst any sum which becomes payable by the Seller to the Buyer under the preceding provisions of this clause 10.5 shall constitute a corresponding reduction in the amount of the Consideration.

| 10.6 | Any payment made pursuant to clause 10 shall carry Interest from the Signing Date to the date of actual payment (both dates inclusive). |

| 10.7 | For the avoidance of doubt no payment shall be payable under the terms of this clause 10 if Completion does not take place. |

| 10.8 | The Seller confirms that Book Debts have been collected and creditors of the Business have been paid in the ordinary course in accordance with the Target’s usual practice. |

| 11 | INDEMNITIES |

| 11.1 | With effect from Completion, the Seller agrees to indemnify and keep indemnified the Buyer and each member of the Target Group from and against all demands, claims, liabilities (whether actual or contingent), losses, costs and expenses whatsoever excluding any losses, costs or expenses in respect of Tax but including all interest, penalties, legal and other costs and expenses, together with value added and similar taxes thereon (if applicable), made against or suffered or incurred by the Buyer or any member of the Target Group in connection with: |

| (a) | the sale, transfer or other disposal of any assets, properties or investments (or any interest in any assets, properties or investments) by the Target prior to Completion whether pursuant to the Transfer Agreements or otherwise including, but not limited to the following related matters: |

| (i) | the transfer of the Target’s interest in the Dominion Theatre and the Buyer’s performance of the obligations in clause 2.5(c); |

| (ii) | the employment or termination of employment before completion of the Transfer Agreements of any of the transferring employees named in the Transfer Agreements or any other person employed in, or assigned to, the business to be transferred pursuant to the Transfer Agreements; |

| (iii) | any failure by the Target to comply with its obligations to any trade union or other worker representative prior to completion of the Transfer Agreements solely in respect of the employees transferred under the Transfer Agreements (the “Transferred Employees”); |

| (iv) | any payments due to the Transferred Employees or any other person employed in, or assigned to, the business to be transferred pursuant to |

17

| the Transfer Agreements, in respect of their employment up to and including the date of completion of the Transfer Agreements (including but not limited to payments under or in connection with any profit related pay or other incentive or bonus scheme applicable to the Transferred Employees or any other person employed in, or assigned to, the business to be transferred pursuant to the Transfer Agreements immediately before completion of the Transfer Agreements) whether or not such payment arises from or in connection with the period of employment on or after completion of the Transfer Agreements; |

| (v) | any accrued but untaken holiday entitlements of the Transferred Employees or any other person employed in, or assigned to, the business to be transferred pursuant to the Transfer Agreements up to and including the date of completion of the Transfer Agreements; |

| (vi) | the employment or termination of employment of any Transferred Employees whose contract of employment does not, or who claims that his contract of employment does not, transfer; |

| (vii) | the employment details of the Transferred Employees or any employee liability information as defined in Regulation 11 of the Transfer of Undertakings (Protection of Employment) Regulations 2006 being in any material respect untrue, inaccurate, incomplete or misleading; |

| (b) | the conduct by any member of the Target Group prior to Completion of any business or activity other than the business or activity as relates to the ownership and/or management and operation of the Properties; |

| (c) | the ownership or occupation by any member of the Target Group prior to Completion of any property other than the Properties; |

| (d) | any guarantees given by any member of the Target Group prior to the date hereof on behalf of any member of the Seller’s Group in relation to any property; |

| (e) | the sale of the Shares pursuant to this agreement including any transaction, brokerage or advisory fees incurred or borne by any member of the Target Group and any fees, commissions, bonuses or other incentives and any costs or expenses paid or payable by any member of the Target Group to any directors, officers, employees, agents or advisers of the Seller’s Group or the Target Group in connection with the sale of the Shares pursuant to this agreement or the preparation of the Target Group for sale prior to Completion; and |

| (f) | any claim or allegation by Key Brand Entertainment Inc (“Key Brand”) in relation to: |

| (i) | the Bidding Rights Agreement effective as of January 23, 2008 and made between Live Nation Worldwide, Inc. and Key Brand; |

| (ii) | the Exclusivity Agreement and Amendment to Bidding Rights Agreement executed on January 15, 2009 and made between Key Brand and Live Nation Worldwide, Inc.; and |

18

| (iii) | any other agreement or arrangement made between Key Brand or any of its subsidiary or associated companies and any member of the Seller’s Group or any of its agents in respect of the Target and/or all or any of its assets or any other pre-emption or matching right in respect of the Target and/or all or any of its assets, |

including the summons and complaint filed by Key Brand in the Superior Court of the State of California under case number BC425092 and any other lawsuit or action in any other court in California or any other state of the United States of America or elsewhere in relation to the same or similar subject matter or in connection with any of the above agreements or arrangements;

| (g) | any claims made by the Landlord in respect of dilapidations which may accrue or have accrued to the Landlord against the tenant of the Lease dated 4 November 2004 made between The Oxford City Council (“Council”) (1) Clear Channel Entertainment (Theatrical) Limited (2) relating to The Old Fire Station, 40 George Street, Oxford and 21 Gloucester Green Oxford under the terms of that Lease which claims are a condition of the acceptance by the Council of a surrender of that Lease by Target PROVIDED THAT: |

| (i) | legal completion of such surrender takes place before 31 December 2010; |

| (ii) | any liability under this clause shall not exceed £90,000 inclusive of VAT; and |

| (iii) | negotiations in respect of the surrender shall be conducted by Terry Carnes or such other person as is appointed by the Seller on behalf of the Target who shall consult with the Buyer in respect of such negotiations and take the Buyer’s instructions in respect of the other aspects of such surrender not concerning dilapidations and the Buyer shall not take (or refrain from taking) any action which would compromise such negotiations. |

| 11.2 | All sums payable by the Seller under this clause 11 shall be paid within 14 Business Days of demand by the Buyer in full without any deduction or withholding. If the Seller is compelled by law to make any deduction or withholding from any such sums or if any payment hereunder shall be or become subject to any tax, duty, levy or impost of any nature (whether before or after the same has been paid to the Buyer) the Seller will immediately pay to the Buyer such additional amount or amounts as will result in payment to and retention by the Buyer of the full amount which would have been received and retained but for such deduction or withholding or the imposition of such tax, duty, levy or impost. |

| 11.3 | Any release, settlement or discharge between the Buyer and the Seller under this clause 11 shall be conditional upon no security or payment made or given to the Buyer being avoided reduced, set aside or rendered unenforceable by virtue of any provision or enactment now or hereafter in force relating to bankruptcy, insolvency or liquidation and if any such security or payment shall be avoided, reduced, set aside or rendered unenforceable the Buyer shall be entitled to recover the full amount or value of any such security or payment from the Seller and otherwise to enforce this clause as if such release, settlement or discharge had not taken place. |

19

| 11.4 | The provisions of paragraph 9 of Schedule 3 shall apply in respect of any claim made by either the Buyer or any member of the Target Group under this clause 11 to provide the Seller with full rights of conduct in respect of any such claims. For the avoidance of doubt, no other provision in Schedule 3 shall in any way limit the liability of the Seller or the Guarantor under this clause 11. |

| 11.5 | Notwithstanding any of the indemnities provided in this clause 11 no indemnity whether express or implied is provided whatsoever in respect of the Pension Schemes and the rights of the members of the Pension Schemes. |

| 12 | GUARANTEE |

| 12.1 | With effect from Completion, the Guarantor hereby irrevocably and unconditionally guarantees as a continuing guarantee the payment when due of all sums due owing or outstanding from the Seller to the Buyer under this agreement and the due performance by the Seller of all and several the Seller’s obligations under this agreement and all documents ancillary hereto and thereto and agrees to indemnify the Buyer from and against all loss, damage, costs and expenses which the Buyer may suffer through or arising from any failure by the Seller to perform any of its said obligations or any failure by the Seller duly, fully and punctually to pay any sum required to be paid by it in relation to or otherwise to perform its said obligations. |

| 12.2 | All sums payable hereunder by the Guarantor shall be paid immediately on demand by the Buyer in full without any deduction, withholding, counter claim or set off. If the Guarantor is compelled by law to make any deduction or withholding from any such sums or if any payment hereunder shall be subject to any tax, duty, levy or impost of any nature (whether before or after the same has been paid to the Buyer) the Guarantor shall immediately pay to the Buyer such additional amount or amounts as shall result in payment to and retention by the Buyer of the full amount which would have been received and retained by the Buyer but for such deduction or withholding or the imposition of such tax, duty, levy or impost. |

| 12.3 | Without prejudice to the Buyer’s rights against the Seller as between the Buyer and the Guarantor, the Guarantor shall be liable hereunder as if it were the sole principal debtor and not merely a surety, and its liability hereunder shall not be released, discharged or diminished by: |

| (a) | any legal limitation lack of capacity or authorisation or defect in the actions of the Seller or any co surety in relation to, any invalidity or unenforceability of, or any variation (whether or not agreed by the Guarantor) of any of the terms of this agreement or any document ancillary hereto or thereto, or the bankruptcy, liquidation, insolvency, or dissolution of the Seller; |

| (b) | any forbearance, neglect or delay in seeking performance of the obligations of the Seller or any co surety, any granting of time indulgence or other relief to the Seller or any co surety in relation to such performance, or any composition with, discharge, waiver or release of the Seller or any co surety; or |

| (c) | any other act, omission, fact or circumstance which might otherwise release, discharge or diminish the liability of a guarantor. |

| 12.4 | Any release, settlement or discharge between the Buyer and the Guarantor shall be conditional upon no security or payment made or given to the Buyer being avoided, |

20

| reduced, set aside or rendered unenforceable by virtue of any provision or enactment now or hereafter in force relating to bankruptcy, insolvency or liquidation and if any such security or payment shall be avoided, reduced, set aside or rendered unenforceable the Buyer shall be entitled to recover the full amount or value of any such security or payment from the Guarantor and otherwise to enforce this clause 12 as if such release, settlement or discharge had not taken place. |

| 13 | SENIOR EMPLOYEES |

| 13.1 | The Buyer (on behalf of itself and hereby undertaking that it shall procure that each member of the Buyer’s Group shall comply with the provisions of this clause 13.1 as if they were themselves the Buyer) hereby agrees that for a period of 12 months after Completion that it shall make no offer of employment to any person who is employed either by the Seller’s Group or by the Target in the immediate 12 month period prior to Completion who has senior managerial responsibility or who is in a position where they deal directly with producers or who is a venue manager. |

| 13.2 | The Seller (on behalf of itself and hereby undertaking that it shall procure that each member of the Seller’s Group shall comply with the provisions of this clause 13.2 as if they were themselves the Seller) hereby agrees that for a period of 12 months after Completion that it shall make no offer of employment to any person who is employed by the Buyer’s Group in the immediate 12 month period prior to Completion who has senior managerial responsibility or who is in a position where they deal directly with producers or who is a venue manager |

| 13.3 | For the purposes of this clause 13 the term “employment” shall include any offer of employment, consultancy, agency, directorship, partnership or any remunerative appointment whatsoever. |

| 14 | PENSIONS |

The current active members of the Live Nation Pension Scheme who are employed at the Southampton Guildhall have become deferred members of the Live Nation Pension Scheme at completion of the Transfer Agreements as they will have ceased to be employees of Target. The Seller will make alternative provision for their future pension provision.

| 15 | CONFIDENTIALITY AND USE OF NAMES |

| 15.1 | The Seller shall not at any time after the date of Completion disclose or knowingly permit there to be disclosed any Confidential Business Information which it has or acquires PROVIDED THAT this clause shall not apply if and to the extent that: |

| (a) | such Confidential Business Information has ceased to be confidential or come into the public domain (other than as a result of breach of any obligation of confidence by the Seller or any member of the Seller’s Group); or |

| (b) | any disclosure of such Confidential Business Information has been authorised by the Buyer; or |

| (c) | disclosure of the Confidential Business Information concerned is required by law or by any regulatory body. |

21

| 15.2 | The Seller shall not at any time after the date of Completion either as principal or partner, alone or jointly with, through or as manager, adviser, consultant or agent for any person or in any other capacity use or otherwise deal with any of the Owned Target Intellectual Property Rights or use or otherwise deal with anything which identical or similar to or is intended, or is likely to be confused with any of the Owned Target Intellectual Property Rights. |

| 15.3 | The Seller shall procure that each member of the Seller’s Group and each of its Associates shall comply with the provisions of this clause as if each such person were a party covenanting with the Buyer. |

| 15.4 | The Buyer hereby undertakes to the Seller to procure that each member of the Target Group shall, at its own expense, within six months after the Signing Date use reasonable efforts to remove all reference to any member of the Seller’s Group and logo on its letterhead, business cards, circulars and advertisements or on any signs or on any assets used by any member of the Target Group or any of their agents and the Buyer shall procure that no member of the Target Group shall carry on business after the expiry of such six month period under any name, style or logo which is similar to or which may be confused with that of any member of the Seller’s Group, or otherwise represent or hold itself out as being in any way connected with the Seller or any such member. |

| 16 | TAX |

The parties agree that the provisions of Schedule 6 shall have effect.

| 17 | ANNOUNCEMENTS |

| 17.1 | Subject to clause 17.2 and Schedule 6, the parties shall not make or authorise any public announcement concerning the terms of or any matters contemplated by or ancillary to this agreement without the prior written consent of all the other Parties such consent not to be unreasonably withheld or delayed. |

| 17.2 | A Party may make or authorise an announcement if: |

| (a) | the announcement is required by law or by any securities exchange or regulatory or government body (whether or not such requirement has the force of law); and |

| (b) | that Party has consulted with and taken into account the reasonable requirements of the other Parties. |

| 18 | GENERAL |

| 18.1 | Except where this agreement provides otherwise, each party shall pay its own costs relating to or in connection with the negotiation, preparation, execution and performance by it of this agreement and of each agreement or document entered into pursuant to this agreement and the transactions contemplated by this agreement. Without prejudice to the foregoing, the Buyer shall pay any stamp duty in respect of the transfer of the Shares. |

| 18.2 | No variation of this agreement or any agreement or document entered into pursuant to this agreement shall be valid unless it is in writing and signed by or on behalf of each of the parties. |

22

| 18.3 | No delay, indulgence or omission in exercising any right, power or remedy provided by this agreement or by law shall operate to impair or be construed as a waiver of such right, power or remedy or of any other right, power or remedy. |

| 18.4 | No single or partial exercise or non-exercise of any right, power or remedy provided by this agreement or by law shall preclude any other or further exercise of such right, power or remedy or of any other right, power or remedy. |

| 18.5 | If the Buyer or the Seller defaults in the payment when due of any sum payable under this agreement or any agreement entered into pursuant to this agreement its liability shall be increased to include interest on such sum from the date when payment is due up to and including the date of actual payment (after as well as before judgement) at the following rates: |

| (a) | for the first 90 days that payment is not made, at a rate equal to the base rate of Barclays Bank plc from time to time calculated on a daily basis (the “Rate”) plus 5%; |

| (b) | for the period between 90 and 180 days that payment is not made, at a rate equal to the Rate plus 7.5%; and |

| (c) | for the period over 180 days that payment is not made, at a rate equal to the Rate plus 10%. |

| 18.6 | The provisions of this agreement insofar as they have not been performed at Completion shall remain in full force and effect notwithstanding Completion. |

| 18.7 | This agreement and each of the agreements and documents executed pursuant to this agreement shall be binding upon and enure for the benefit of the successors in title of the parties. |

| 18.8 | Save as provided by this clause 18.8 no person who is not a party to this agreement shall have any right to enforce this agreement or any agreement or document entered into pursuant to this agreement pursuant to the Contracts (Rights of Third Parties) Act 1999 (other than clause 8.7 which may be enforced by any of the Officers, clause 11.1 which may be enforced by any member the Target Group and paragraph 12 in Part 4 of Schedule 6 which may be enforced by the Target). |

| 18.9 | Following Completion, each party shall take any action (or procure the taking of any action) which any of the other parties from time to time may at the cost of the requesting party reasonably request in writing to carry into effect the terms of this agreement. |

| 19 | ASSIGNMENT |

| 19.1 | No party may assign, transfer, charge, make the subject of a trust or deal in any other manner with any of its rights under it or purport to do any of the same nor sub-contract any or all of its obligations under this agreement without the prior written consent of the other parties (provided that the Buyer may freely assign this agreement by way of security to any bank or financial institution providing debt finance for its acquisition of the Shares). |

23

| 19.2 | The Seller’s liability under this agreement to an assignee following any assignment shall be no greater than it would have been to the Buyer if the agreement had not been assigned. |

| 20 | ENTIRE AGREEMENT |

| 20.1 | This agreement and any agreement or document entered into pursuant to this agreement constitutes the entire agreement between the parties and supersedes any previous agreement or arrangement between the parties relating to the acquisition of the Shares. |

| 20.2 | The Buyer agrees that it has not entered into this agreement or any agreement or document entered into pursuant to this agreement in reliance upon any representation, statement, covenant, warranty, agreement or undertaking of any nature whatsoever made or given by or on behalf of the Seller except as expressly set out in this agreement or any agreement or document entered into pursuant to this agreement. The Buyer waives any claim or remedy or right in respect of any representation, statement, covenant, warranty, agreement or undertaking of any nature whatsoever made or given by or on behalf of the Seller unless and to the extent that a claim lies for damages for breach of this agreement or any agreement or document entered into pursuant to this agreement. Nothing in this clause shall exclude any liability on the part of the Seller for fraud or fraudulent misrepresentation. |

| 21 | NOTICES |

| 21.1 | Any notice given under this agreement shall be in writing and signed by or on behalf of the party giving it and may be served by delivering it by hand or sending it by pre-paid recorded delivery or registered post (or registered airmail in the case of an address for service outside the United Kingdom) in each case to the appropriate addresses set out below or to such other address as is last notified in writing to the parties: |

If to the Buyer to:

The Ambassador Theatre Group Limited

The Ambassadors

Peacocks Centre

Woking

Surrey

GU21 6GQ

Attention: Peter Kavanagh

with a copy to Denton Wilde Sapte LLP of One Fleet Place, London, EC4M 7WS

Attention: Andrew Hill

If to the Seller to:

24

Apollo Leisure Group Limited

Second Floor

Regent Arcade House

19-25 Argyll Street

London W1F 7TS

with a copy to Hammonds LLP, 7 Devonshire Square, London, EC2M 4YH

Attention: Nicholas Allen

If to the Guarantor to:

Live Nation, Inc

9348 Civic Center Drive

Beverly Hills California 90210

Attention: John Hopmans

with a copy to: Gardere, Wynne Sewell LLP, 1000 Louisiana Street, Suite 3400 Houston Texas

Attention: Mike Rogers

| 21.2 | Subject to clause 21.3, in the absence of evidence of earlier receipt, any notice given pursuant to this clause shall be deemed to have been received: |

| (a) | if delivered by hand, at the time of actual delivery to the address referred to in clause 21.1; |

| (b) | in the case of pre-paid recorded delivery or registered post, two Business Days after the date of posting; and |

| (c) | in the case of registered airmail, five Business Days after the date of posting; |

| 21.3 | If deemed receipt under clause 21.2 occurs before 9.00 am on a Business Day, the notice shall be deemed to have been received at 9.00 am on that day. If deemed receipt occurs on any day which is not a Business Day or after 5.00 pm on a Business Day the notice shall be deemed to have been received at 9.00 am on the next Business Day. |

| 21.4 | For the avoidance of doubt, notice given under this agreement shall not be validly served if sent by e-mail. |

| 22 | COUNTERPARTS |

This agreement may be executed in any number of counterparts and by the different parties on separate counterparts (which may be facsimile copies), but shall not take effect until each party has executed at least one counterpart. Each counterpart shall constitute an original but all the counterparts together shall constitute a single agreement.

| 23 | GOVERNING LAW AND JURISDICTION |

| 23.1 | This agreement shall be governed by and construed in accordance with English law. |

25

| 23.2 | Each party irrevocably agrees to submit to the exclusive jurisdiction of the courts of England in relation to any claim or matter arising under or in connection with this agreement (or any agreement or document entered into pursuant to this agreement). |

IN WITNESS of which the parties have executed this document as a deed on the date set out above.

26

SCHEDULE 1

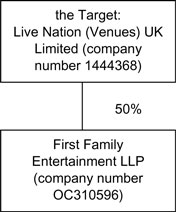

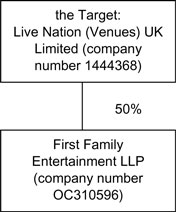

Part 1 – Target Group

27

Part 2 – Details of the Target

| Registered Number: | 1444368 | |

| Type of Company: | Private company limited by shares | |

| Date of incorporation: | 17 August 1979 | |

| Country of incorporation: | England and Wales | |

| Authorised Share Capital: | £1,000 divided into 1,000 Ordinary Shares of £1.00 each | |

| Issued Share Capital: | 200 Ordinary Shares of £1.00 each | |

| Registered Office: | 2nd Floor, Regent Arcade House 19-25 Argyll Street London W1F 7TS | |

| Directors: | Stuart Robert Douglas Paul Robert Latham Alan Brian Ridgeway | |

| Secretary: | Selina Holliday Emeny | |

| Accounting Reference Date: | 31 December | |

| Auditors: | Ernst & Young LLP 1 More London Place London SE1 2AF | |

| Registered Charges: | Legal charge dated 4 November 2004 (registered 20 November 2004) relating to The Old Fire Station, 40 George Street, Oxford (the “Mackintosh Foundation Charge”) | |

28

Part 3 – Subsidiary

| Name of Subsidiary: | First Family Entertainment LLP | |

| Registered Number: | OC310596 | |

| Type of Company: | Limited liability partnership | |

| Date of incorporation: | 11 December 2004 | |

| Country of incorporation: | England and Wales | |

| Registered Office: | The Ambassadors Peacocks Centre Woking Surrey GU21 6GQ | |

| Accounting Reference Date: | 31 March | |

| Auditors: | Saffery Champness Lion House Red Lion Street London WC1R 4GB | |

| Designated Members: | Live Nation (Venues) UK Limited The Ambassador Theatre Group Limited | |

| Registered Charges: | None | |

29

SCHEDULE 2

Warranties

| 1 | CORPORATE MATTERS |

| 1.1 | Authority and Capacity |

| (a) | The Seller has full power and authority to enter into and perform this agreement and any agreement or document to be entered into by the Seller pursuant to this agreement which constitute valid and binding obligations on the Seller in accordance with its terms. |

| (b) | The Seller has taken all corporate and other action necessary to enable it to enter into and perform this agreement and any agreement or document to be entered into pursuant to this agreement. |

| (c) | The execution and delivery of, and the performance by the Seller of its obligations under, this agreement and any agreement or document entered into pursuant to this agreement will not: |

| (i) | result in a breach of any provision of the Memorandum or Articles of Association of the Seller; |

| (i) | result in a breach of, or constitute a default under, any instrument to which the Seller is a party or by which the Seller is bound; |

| (ii) | result in a breach of any order, judgment or decree of any court or governmental agency to which the Seller is a party or by which the Seller is bound; or |

| (iii) | require the consent of its shareholders or of any other person, |

and is not otherwise the subject of any restrictions.

| 1.2 | Title to the Shares |

| (a) | The Seller is the only legal and beneficial owner of the Shares. |

| (b) | The Shares have been validly allotted and issued, are fully paid or are properly credited as fully paid. |

| (c) | There is no Security Interest on, over or affecting any of the Shares and there is no agreement or arrangement to give or create any such Security Interest. No claim has been or will be made by any person to be entitled to any such Security Interest. |

| (d) | The Target has not created or granted or agreed to create or grant any Security Interest in respect of any of its uncalled share capital. |

| (e) | Except as required by this agreement, there are no agreements or arrangements in force which provide for the present or future allotment, issue, transfer, redemption or repayment of, or grant to any person of the right (whether |

30

| conditional or otherwise) to require the allotment, issue, transfer, redemption or repayment of, any share or loan capital of the Target (including any option or right of pre-emption or conversion). |

| 1.3 | Changes in share capital |

Since the Last Accounts Date:

| (a) | no share or loan capital has been issued or allotted, or agreed to be issued or allotted, by the Target; and |

| (b) | the Target has not redeemed or purchased or agreed to redeem or purchase any of its share capital. |

| 1.4 | Subsidiaries and other interests |

| (a) | As set out in Schedule 1 Part 3 the Target is the sole legal and beneficial owner of the whole of the 50% membership interest in the Subsidiary. |

| (b) | Apart from the Subsidiary, the Target does not own or have any interest of any nature whatsoever in any shares, debentures or other securities of any body corporate, whether incorporated in any part of the United Kingdom or elsewhere. |

| 1.5 | Directors |

The Target has not been a party to any transaction to which the provisions of sections 190; 191; 197; 198; 200; 201; 203 or 223 of the Companies Act 2006 may apply.

| 1.6 | Corporate compliance |

| (a) | The Target has at all times carried on business and conducted its affairs in all material respects in accordance with its Memorandum and Articles of Association for the time being in force and any other documents to which it is or has been a party. |

| (b) | The Target is empowered and duly qualified to carry on business in all jurisdictions in which it now carries on business. |

| (c) | Due compliance has been made with all the provisions of the Companies Acts and other legal requirements in connection with the formation of the Target, the allotment or issue of any of its shares, debentures and other securities and the payment of dividends. |

| 1.7 | Accuracy of Information |

| (a) | The information in Schedule 1 and Schedule 4 is true and accurate in all respects. |

| (b) | Subject to sub-clause (d) below, the responses provided by: |

| (i) | the Seller to enquiries made by the Buyer in respect of the Target Group as detailed in the document in the agreed form entitled “Project Hannibal – Q&A Template”; and |

31

| (ii) | the Seller’s Solicitors to enquiries made by the Buyer’s Solicitors in respect of the Properties as set out in the Data Room, |

are true and accurate in all material respects.

| (c) | Subject to sub-clause (d) below: |

| (i) | the agreements and documents contained in the Data Room are true and complete copies and there are no agreements or documents which are not contained in the Data Room which amend, vary, supplement or supersede any of such agreements or documents |